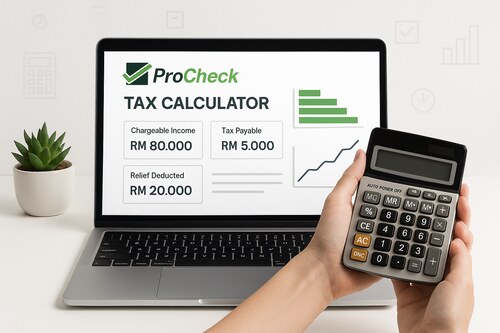

Income Tax Calculator

Malaysia

Income Tax Calculator Malaysia

Use our ‘Tax Estimator’ calculator to estimate your personal income tax. Simple, fast, and accurate – helping you plan your finances more efficiently.

Income Tax Calculator Malaysia

Looking to estimate your personal tax obligations in Malaysia quickly and accurately? Say hello to the Income Tax Calculator Malaysia—your go-to tool to get a precise tax estimate in just a few clicks.

Are you a business owner?

Our calculator is designed for individual use. For expert guidance on corporate or SME tax matters, explore our full range of tax services.

Why Use Our Income Tax Calculator Malaysia?

Fast & Accurate: No more guesswork. Instantly arrive at a tax estimate that’s grounded in Malaysia’s latest tax rates and relief schemes.

Effortless Planning: Whether you’re an employee, freelancer, or business owner, this calculator helps you budget smarter and manage cash flow with confidence.

User-Friendly Interface: Simply input your income, deductions, and residency status—our calculator takes care of the rest.

Who Benefits Most from This Tool?

Salaried Individuals: Effortlessly assess your tax liability after factoring in EPF, SOCSO, insurance, and lifestyle reliefs.

Self-Employed or Freelancers: Evaluate your net chargeable income after eligible deductions—staying compliant has never been easier.

SMEs & Company Owners: Get early insights into your corporate tax obligations, helping you plan strategically.

How It Works: Step-by-Step

Enter Your Income: Fill in your total annual income—salary, freelance revenue, or business profits.

Choose Your Status: Specify your tax residency and category (individual or SME/company).

Include Reliefs & Deductions: Add common reliefs like personal, spouse, children, lifestyle, EPF, and SOCSO.

The calculator applies Malaysia’s progressive tax rates for individuals (0%–30%) to deliver your estimated personal tax liability. It does not calculate SME or company tax rates. Running a business? For accurate corporate tax planning, speak with our team and explore our tax services.

Note: These tax brackets and relief thresholds align with recent guidance from the Inland Revenue Board and detailed insights in our income taxes Malaysia blog.

Ready to Go Beyond DIY?

Estimating your tax liability is a smart start—but when accuracy, optimization, and peace of mind matter, professional support is unmatched. Whether it’s filing complexities, planning tax-saving strategies, or ensuring compliance, our team is here to help.

Looking for expert tax services to guide you through every step with precision? Explore our tailored solutions and get started today with Procheck’s professional tax support.

Frequently Asked Questions (FAQ)

Frequently Asked Questions (FAQ)

Q: Does the calculator factor in tax reliefs like personal or lifestyle relief?

Yes — it includes inputs for personal, spouse, children, EPF, SOCSO, lifestyle, education, and more. The final estimate deducts eligible reliefs to calculate chargeable income accurately.

Q: Are the tax rates up to date?

Absolutely. We use Malaysia’s current progressive rates for individuals (0%–30%) based on the latest updates from the Inland Revenue Board.

Q: Can this calculator help with corporate tax planning?

This calculator is specifically designed for personal income tax estimation. If you’re a business owner or managing a company, we recommend speaking directly with our experts for an accurate and optimized tax strategy.

👉 Explore our tax services for professional assistance tailored to business and SME tax planning.

Why Procheck?

Use the Income Tax Calculator Malaysia as your first step toward smarter financial planning. Then, level up accuracy and efficiency—let Procheck’s expert tax services guide you to more predictable, optimized tax outcomes.

Start your tax journey now:

Calculate your tax instantly with the Income Tax Calculator Malaysia

Explore our professional tax services to streamline and enhance your compliance and strategy

Explore Our Best Services

Explore PROCHECK's best services in tax, advisory, and consulting. We provide expert solutions to enhance compliance, optimize efficiency, and support your growth.

Tax Services

Navigate complex tax regulations with strategic tax planning, compliance, and advisory services to optimize financial performance and minimize risks.

Accounting Advisory

Ensure accurate financial reporting, effective internal controls, and strategic financial planning with our comprehensive accounting advisory services.

Our Customer's Feedback

Discover the experiences of our satisfied clients, highlighting the value, reliability, and integrity of our services.

EXCELLENTTrustindex verifies that the original source of the review is Google. Terbaikkk! Well explained, recommended 👍👍Posted onTrustindex verifies that the original source of the review is Google. Good servicePosted onTrustindex verifies that the original source of the review is Google. Good! Servis yang sangat mantapPosted onTrustindex verifies that the original source of the review is Google. Friendly and supportive teamPosted onTrustindex verifies that the original source of the review is Google. Service awesomePosted onTrustindex verifies that the original source of the review is Google. Ok cool👍Posted onTrustindex verifies that the original source of the review is Google. Superbbbb

Subscribe Newsletter For Latest Update

Stay updated with the latest insights, services, and expert advice to drive your business growth. Be the first to know about our exclusive offers and news directly in your inbox!

Our Insights And Blog

Explore our latest insights and blog posts for valuable perspectives and expert advice from Pro Check on assurance, taxation, corporate services, and business consulting.

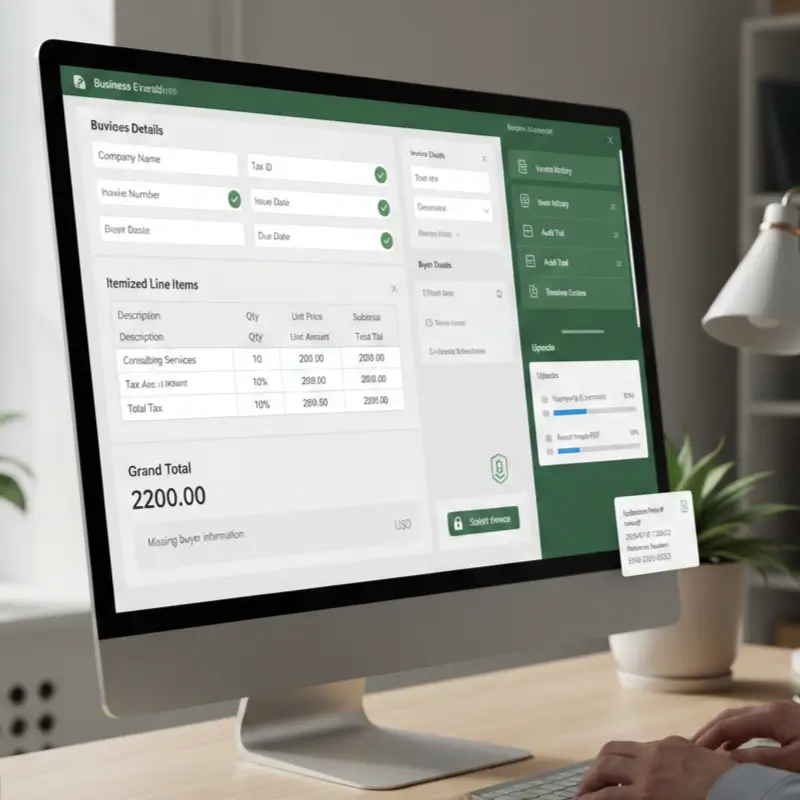

8 Steps: How Do You Create an e invoicing sample That Passes Tax Review

12 Facts: What Is an e invoicing form and Why It Matters for Tax Compliance