Key Takeaways (Q&A)

Q1: What is management reporting, and why is it 7 times more useful than financial statements for day-to-day control?

A: Management reporting is an internal, decision-focused reporting pack that tracks operational performance, cash, and risks in near real time, so SMEs, groups, and startups can act before issues appear in month-end financial statements.

Q2: How does management reporting work in practice for faster daily decisions?

A: It converts bookkeeping transactions into structured KPIs, variance analysis, and segmented profitability views using disciplined coding, reconciliations, and a consistent cadence, giving leaders timely signals instead of compliance-only summaries.

Q3: What should you do next if you want better control without micromanaging?

A: Define 10–15 decision-linked KPIs, set weekly review rhythms, assign metric owners, and standardise templates; then engage an accounting advisory team to build a reliable management pack aligned with governance, tax, and internal controls.

Management reporting is the difference between “knowing the numbers” and actually controlling what happens in your business every day. Financial statements are essential for compliance, tax filing, bank requirements, and statutory credibility—but they are usually backward-looking, consolidated, and produced after the month ends, when many decisions are already locked in.

In contrast, a well-built management reporting pack turns daily transactions into operational signals: cash pressure, margin drift, receivables risk, cost leakage, and performance by product, client, department, or project—so leaders can intervene early.

For SMEs, startups, and fast-scaling groups in Malaysia, this matters because day-to-day control is rarely lost in one big event; it erodes through small delays, unclear ownership, and “we’ll check it at month-end” habits.

Simplify Your Tax Management Today!

Partner with Procheck today to unlock your business’s full potential. Our team of experts is ready to help you navigate taxation challenges and achieve your strategic goals.

Request a Free Consultation

Get started with a no-obligation consultation to discover how we can transform your financial operations.

In Putrajaya and across the Klang Valley, businesses also face real pressure from tighter governance, documentation needs, and stakeholder expectations—especially during restructuring or M&A due diligence. That’s where a disciplined reporting cadence, clear KPI definitions, and reconciled data can protect both performance and compliance.

Procheck Faculty Sdn Bhd, a 100% Bumiputera-owned professional services firm with over 25 years of experience in assurance, tax, corporate services, and advisory, often sees the same pattern: when management reporting is structured properly, leadership meetings become decision sessions—not debates about whose spreadsheet is correct.

As one client,

“Perkhidmatan Setiausaha Syarikat dari Procheck sangat profesional dan cekap… memastikan pematuhan undang-undang."

Noor Ariffshah ★★★★★

That same discipline—accuracy, documentation, and governance—also makes management reporting far more useful than financial statements for daily control.

What Is Management Reporting and How Does It Differ From Financial Statements for Day-to-Day Control?

Management reporting is an internal performance system built for operational control, while financial statements are statutory outputs designed for compliance, tax, banks, and external stakeholders—so they differ in purpose, timing, and decision usefulness.

Management reporting explained in plain business terms

Management reporting turns daily transactions into decision-ready KPIs, variance notes, and operational actions, using consistent definitions so managers can control cash, margin, and execution without waiting for month-end.

Financial statements explained for compliance and external users

Financial statements summarise past performance under accounting standards, prioritising accuracy, auditability, and comparability, which makes them essential for statutory reporting but less suited to daily operational steering.

The “day-to-day control” gap: timing, granularity, and accountability

Day-to-day control needs fast, granular, owner-assigned metrics (collections, burn rate, margin by product), while financial statements are aggregated and late, making root-cause diagnosis slower.

Where management reporting fits inside modern accounting workflows

A practical workflow connects bookkeeping, reconciliations, and management packs into a weekly cadence, then feeds clean numbers into month-end reporting, tax computations, and audit trail readiness.

If you want a strong baseline before building dashboards and KPIs, start by tightening your Book of Accounts.

Why Is Management Reporting More Actionable Than Financial Statements When Leaders Need Daily Decisions?

Management reporting is more actionable because it links numbers to operational levers—pricing, staffing, purchasing, collections, and delivery—so leaders can intervene before losses become “historical facts” in month-end statements.

Actionability drivers: frequency, ownership, and operational context

Actionability comes from short reporting cycles, named KPI owners, and context notes that explain operational drivers, not just totals.

Decision cycles: daily, weekly, monthly—what changes and why

Daily signals protect cash, weekly reviews correct performance drift, and monthly reviews confirm governance and compliance—each cycle answers different management questions.

What “actionable” looks like for SMEs vs multi-entity groups

SMEs need cash visibility and cost control, while groups need intercompany clarity, segment reporting, and consistent KPI definitions across entities.

How Can Management Reporting Turn Raw Accounting Data Into Operational Signals You Can Act On?

Management reporting converts raw accounting entries into operational signals by enforcing consistent coding, mapping transactions to drivers, and adding variance logic, so the data becomes a control system instead of a record archive.

From transactions to signals: categorisation, tagging, and rules

Signals require disciplined charts of accounts, cost centres, project tags, and rules that classify spending and revenue into meaningful management views.

Turning variance into cause: bridging finance and operations

Variance becomes useful when finance ties movements to operational causes like discounting, overtime, wastage, churn, or supplier price changes.

A practical example: sales mix, margin drift, and expense creep

A weekly margin-by-product view can reveal discount-heavy sales mix shifts, while expense creep often shows up as repeat small transactions that bypass budget discipline.

The management reporting pipeline: data → logic → insight → action

A reliable pipeline uses reconciled source data, consistent KPI definitions, exception thresholds, and an action log that assigns owners and deadlines.

Which Management Reporting KPIs Help Management Control Costs and Performance Without Waiting for Month-End?

The best KPIs for daily control focus on cash movement, gross margin stability, receivables risk, and controllable cost drivers, because these are the fastest levers to protect profitability and continuity.

Core daily-control KPIs: cash, margin, receivables, payables

Daily-control KPIs include cash runway, collection ageing, top overdue customers, gross margin drift, and supplier payment commitments.

Operational KPIs finance should monitor: utilisation, wastage, rework

Operational KPIs like utilisation, defect/rework rate, returns, and wastage translate directly into margin protection.

KPI ownership and cadence: who reviews what, and when

KPIs work only when owners, thresholds, and review rhythm are defined, so decisions happen consistently rather than “when someone has time.”

Mapping management reporting KPIs to daily control decisions

Map each KPI to a decision: renegotiate supplier terms, tighten credit, adjust pricing, pause noncritical spend, or rebalance staffing.

What Information Should Management Reporting Include to Support Budgeting, Forecasting, and Cash Control?

A useful management pack includes actuals, drivers, variances, and forward-looking forecasts, because budgeting without driver-tracking becomes a spreadsheet ritual that fails under real operational pressure.

Minimum viable management pack: what to include (and exclude)

A minimum pack includes P&L by segment, cash movement, ageing, KPI dashboard, variance notes, and an action tracker—excluding excessive detail that delays delivery.

Rolling forecast basics: assumptions, drivers, and sensitivity

A rolling forecast uses key drivers (sales volume, pricing, payroll, rent, ad spend) and tests sensitivity so leaders can plan for downside scenarios.

Cash control essentials: collections, payments, and working capital

Cash control needs a weekly collections plan, payment schedule, and working capital view that highlights inventory, debtor days, and creditor commitments.

Turning budgets into operating targets managers can follow

Translate budgets into weekly targets per department or project, then track variances with accountable owners and corrective actions.

How Do Management Reporting Dashboards Help You Spot Problems Earlier Than Traditional Financial Statements?

Dashboards surface trend breaks and exceptions quickly through visual thresholds and drill-down, so issues like margin erosion or overdue receivables appear early instead of being discovered after month-end.

Dashboards vs static reports: speed, clarity, and drill-down

Dashboards accelerate understanding by highlighting exceptions, while static reports often hide signals inside aggregated totals.

Early-warning indicators: thresholds, alerts, and trend breaks

Early-warning indicators include cash runway dips, margin variance thresholds, overdue receivable spikes, and unusual vendor payments.

Common dashboard formats: by function, by entity, by product line

Dashboards can be structured by finance function, business unit, or product line to match decision rights and responsibilities.

Why Are Management Reporting Reports Built for Internal Teams While Financial Statements Serve External Stakeholders?

Management reporting is built to support internal execution and accountability, while financial statements are designed to satisfy external trust requirements like regulators, banks, investors, and auditors.

Primary audience and purpose: management vs regulators/banks

Internal reports optimise decisions; external reports optimise credibility, compliance, and standardised disclosure.

Governance: internal controls, approvals, and accountability

Internal governance needs clear owners, sign-offs, and exception handling, especially for payroll, expense approvals, and procurement controls.

Keeping one source of truth while serving different audiences

One reconciled dataset can feed both management packs and statutory reporting, reducing disputes and improving audit trail consistency.

How Can Management Reporting Segment Profitability by Department, Product, Client, or Project for Better Control?

Segmentation reveals which departments, products, clients, or projects truly generate profit after direct and allocated costs, enabling leaders to fix pricing, scope creep, and resource allocation with evidence.

Segmentation methods: cost centres, projects, classes, dimensions

Use cost centres, project codes, and dimensions to allocate revenue and cost accurately across operational units.

Allocation rules that don’t destroy trust

Allocations should be transparent, consistent, and explainable, otherwise managers reject the numbers and the control system collapses.

Profitability views that support pricing and resource decisions

Profitability views should show contribution margin, service effort, and cash impact so leaders can make pricing and resourcing decisions confidently.

A segmentation template leaders can adopt quickly

Start with three layers: direct costs, controllable overheads, then shared overhead allocations, and review allocation logic quarterly.

Which Types of Management Reporting Are Most Useful for CEOs, CFOs, and Business Owners Managing Daily Operations?

The most useful reporting types depend on decision rights: CEOs need execution and growth signals, CFOs need control and forecast integrity, and owner-managers need cash and collections discipline.

CEO view: growth, cash, risk, and execution

A CEO pack prioritises sales pipeline quality, margin stability, cash runway, and top operational risks.

CFO view: controls, variance, forecasting, and board readiness

A CFO pack focuses on reconciliations, variance bridges, forecast drivers, and governance evidence that supports stakeholder confidence.

Owner-manager view: sales, cost discipline, and collections

Owner-managers benefit most from daily collections plans, controllable spend monitoring, and simple margin-by-product indicators.

Matching report types to leadership roles and decision rights

Match each dashboard to a clear action: approve spend, adjust pricing, enforce credit terms, or redeploy resources.

When Should a Business Review Management Reporting to Maintain Day-to-Day Control Without Micromanaging?

The best review cadence is structured and predictable—daily for critical cash signals, weekly for performance drift, and monthly for compliance alignment—so leaders maintain control through systems, not constant intervention.

Cadence framework: daily signals, weekly rhythm, monthly closure

A cadence framework prevents chaos by setting fixed review slots and limiting ad-hoc reporting requests.

Trigger-based reviews: what events should force a review

Trigger reviews when cash runway drops, overdue receivables spike, margins drift beyond thresholds, or major operational changes occur.

Meeting discipline: agendas that prevent micromanagement

A disciplined agenda uses exceptions first, then assigns actions, then tracks closure—avoiding lengthy debates on raw numbers.

What Are the Common Mistakes That Make Management Reporting Useless Even When Financial Statements Look Correct?

Management reporting fails when definitions are inconsistent, data is late or manual, KPI ownership is unclear, and reconciliation discipline is weak—because leaders stop trusting the pack and revert to guesswork.

Mistake 1–3: wrong metrics, inconsistent definitions, no owners

Wrong metrics and no owners create noise, while inconsistent definitions create conflict across teams and entities.

Mistake 4–6: late data, manual errors, over-designed packs

Late packs, manual spreadsheets, and overly complex formats delay decisions and increase error rates.

How to fix trust issues: reconciliation and sign-off rules

Fix trust with reconciliations, version control, sign-offs, and a “single source of truth” principle.

A quick diagnostic checklist for management reporting quality

Check timeliness, reconciliation status, KPI definitions, ownership, exception thresholds, and action closure rates.

How Can Management Reporting Improve Compliance Readiness While Still Focusing on Operational Performance?

Management reporting strengthens compliance by enforcing documentation, control evidence, and reconciliation habits, while still keeping the focus on operational drivers that protect cash flow, profitability, and governance confidence.

Controls that help both operations and compliance

Controls like approval thresholds, segregation of duties, and documented workflows prevent leakage and support audit readiness.

Audit trail habits: documentation, approvals, and exception logs

Audit trail habits include keeping invoices, approvals, variance explanations, and exception logs consistent and retrievable.

Keeping compliance “ready” without turning reports into bureaucracy

Use lean templates and focus on exceptions so compliance discipline supports speed rather than slowing operations.

Why Do Businesses Struggle With Management Reporting Data Collection and How Can Processes Fix It?

Businesses struggle due to inconsistent coding, missing source documents, siloed teams, and weak closing routines, and the fix is process discipline supported by accounting governance and practical automation.

Root causes: inconsistent coding, missing documents, siloed teams

Coding inconsistency and missing documents create rework, while silos between finance and operations delay decisions.

Process fixes: chart of accounts discipline and workflows

Process fixes include a clean chart of accounts, standard coding guides, and defined workflows for invoices, claims, and approvals.

Practical automation: bank feeds, rules, and standard templates

Automation reduces manual effort using bank feeds, posting rules, and standard templates for recurring transactions.

The “book close” routine that makes reporting reliable

A weekly mini-close (bank reconciliation, key accruals, ageing review) improves reporting speed and reduces month-end surprises.

To reduce coding errors and posting confusion, train your team on Bookkeeping Debits and Credits and lock definitions early.

How Can Management Reporting Support Risk Management and Internal Controls to Reduce Errors and Fraud?

Management reporting reduces risk by highlighting anomalies early—unusual payments, margin outliers, and vendor concentration—while internal controls enforce preventive barriers that reduce error rates and fraud exposure.

Risk signals: unusual payments, margin anomalies, vendor concentration

Risk signals include round-number payments, duplicate vendors, sudden margin swings, and high dependence on a single supplier or customer.

Control design: segregation of duties and approval thresholds

Control design assigns separate roles for requesting, approving, and paying, with thresholds that scale with business size and complexity.

Exception reporting: the fastest way to detect issues early

Exception reporting flags unusual patterns automatically, so management investigates quickly rather than discovering issues after financial damage occurs.

Linking management reporting to internal control testing

Use the management pack as evidence for control testing and governance reviews during audits, restructurings, or due diligence.

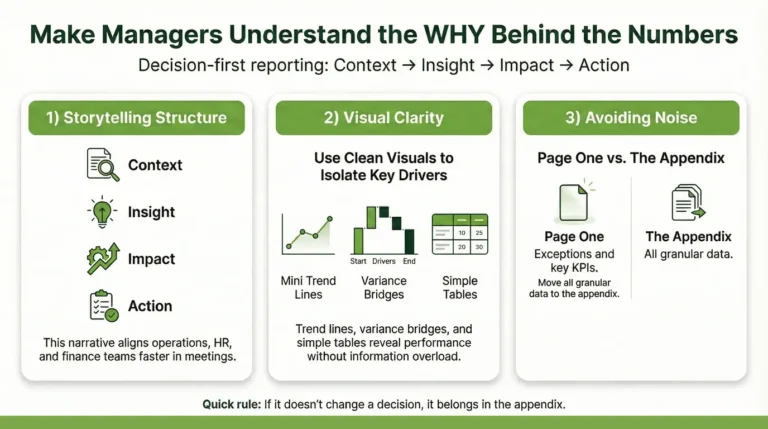

What Is the Best Way to Present Management Reporting Insights So Managers Understand the “Why” Behind the Numbers?

The best presentation uses a decision-first structure—context, insight, impact, action—supported by clean visuals and short variance explanations, so managers focus on causes and fixes rather than debating spreadsheet mechanics.

Storytelling structure: context → insight → impact → action

A consistent narrative helps managers align quickly, especially in cross-functional meetings involving operations, HR, and finance.

Visual clarity: trend lines, variance bridges, and simple tables

Use trends, bridges, and concise tables to show movement over time and isolate drivers without overwhelming detail.

Avoiding noise: what to show on page one vs appendix

Put exceptions and key KPIs on page one, and move granular listings to appendices for reference only.

Which Management Reporting Reports Help Explain Variances Between Budget vs Actual Without Guesswork?

Variance-friendly reports separate price, volume, mix, and efficiency drivers and attach accountable explanations, so leaders understand what changed, why it changed, and what corrective action closes the gap.

Variance analysis essentials: price, volume, mix, efficiency

Variance essentials isolate whether results moved due to pricing changes, sales volume shifts, customer mix, or operating efficiency.

Departmental variance packs: standard questions managers must answer

Managers should answer: what happened, what caused it, what action will fix it, and when it will normalise.

Forecast updates: how variance feeds next-month decisions

Variance insights should update forecasts and operational plans, not remain as commentary after the month is closed.

A variance “bridge” layout managers can understand fast

A bridge layout shows starting budget, key drivers up/down, and ending actual, with notes tied to operational levers.

Where Can SMEs Get Management Reporting Support That Connects Accounting, Strategy, and Performance Tracking?

SMEs benefit most from integrated support that combines bookkeeping discipline, accounting advisory, KPI design, and governance routines, because day-to-day control requires both clean data and strategic interpretation.

What “support” should include: setup, cadence, governance, coaching

Support should include pack design, KPI definitions, monthly governance, and coaching managers to use the pack consistently.

What to prepare before engaging advisors: data, goals, constraints

Prepare your chart of accounts, payroll structure, sales channels, and top pain points such as cash collection delays or cost leakage.

How Procheck-style accounting support links reporting to decisions

An integrated firm can connect management packs to tax planning, compliance readiness, internal controls, and advisory insights for restructuring or growth.

Which Companies Offer Management Reporting Consultancy Services in Malaysia for Ongoing Decision Support?

The right consultancy is one that can implement governance, improve reporting cadence, and connect performance tracking to compliance and strategic outcomes, especially for SMEs, multi-entity groups, and M&A scenarios.

What to evaluate in a consultancy: methodology, governance, and outcomes

Evaluate whether the provider delivers templates, definitions, reconciliation discipline, and measurable outcomes like faster close, fewer surprises, and stronger control.

Questions to ask providers: deliverables, cadence, handover, controls

Ask about deliverables, cadence, ownership model, handover to internal teams, and how controls are maintained under staff turnover.

Matching consultancy scope to SMEs, groups, and M&A situations

Scope should match complexity: SMEs need lean packs, groups need consolidation discipline, and M&A needs clean segmentation and due diligence readiness.

Where Can You Find Training Courses for Mastering Management Reporting Tools and Reporting Discipline?

Training is most effective when it combines tool skills (Excel, dashboards, reporting automation) with discipline skills (definitions, reconciliations, variance logic), because software without governance produces fast but unreliable reporting.

Tools vs discipline: why software alone doesn’t solve reporting

Tools speed up reporting, but discipline ensures the numbers are trusted, repeatable, and decision-ready.

Skills roadmap: Excel models, dashboarding, and variance analysis

A skills roadmap includes Excel modelling, dashboard design, KPI governance, and variance analysis for operational interpretation.

Internal capability building: templates, playbooks, and review habits

Build internal capability using templates, playbooks, and review habits that survive staff changes and business expansion.

How Do You Manage Access Control in Management Reporting So Sensitive Financial Data Stays Confidential?

Access control protects confidentiality by limiting data visibility through roles, approvals, and audit logs, ensuring sensitive payroll, pricing, and profitability data is shared only with authorised decision-makers.

Role-based access: who should see what and why

Role-based access gives department heads what they need (KPIs and budgets) while restricting sensitive details like payroll lines, executive compensation, or client profitability.

Practical controls: approvals, audit logs, and export restrictions

Use approvals, audit logs, and export restrictions to reduce leakage, especially when packs are shared via email, cloud drives, or messaging apps.

Data privacy basics for Malaysian businesses and multi-entity groups

Apply clear data-handling rules for financial packs, limit distribution lists, and standardise secure storage to avoid accidental exposure during audits, restructuring, or staff turnover.

A permission matrix for management reporting packs and dashboards

A permission matrix defines each role, permitted views, export rights, and approval responsibilities, so access remains consistent and defensible under governance reviews.

Management reporting becomes a daily control system when it is built on disciplined coding, reconciliations, clear KPI ownership, and a predictable review cadence—so leaders can act on cash, margin, and risk signals before they harden into month-end results.

Financial statements remain essential for statutory compliance, taxation, and stakeholder credibility, but they rarely explain operational causes fast enough. For SMEs, multi-entity groups, and businesses in change or M&A cycles, a reliable management pack turns meetings into decisions, not debates.

If you want management reporting that your managers actually use, start with a practical design: KPI definitions, segmentation logic, a weekly mini-close routine, and governance rules that protect accuracy and confidentiality.

Procheck can help you implement this end-to-end—linking reporting discipline to compliance readiness, advisory insights, and decision support via their Accounting Services. The goal is simple: fewer surprises, faster action, and better day-to-day control without micromanagement.

FAQ

What is the simplest management reporting pack for a small business?

A starter management reporting pack should include a weekly cash position, receivables ageing, top expenses vs budget, and a short KPI dashboard, because these items drive day-to-day decisions without forcing complex models or heavy reporting overhead.

How often should management reporting be updated for fast-moving businesses?

Management reporting should be updated weekly at minimum, with daily cash and collections signals, because operational drift happens quickly and leaders need timely indicators to correct pricing, costs, and customer credit risk early.

Can management reporting work if my book close is always late?

Management reporting can still work using a weekly mini-close approach, because partial reconciliations, standard accrual rules, and consistent coding can produce reliable directional signals while you gradually improve the month-end close process.

What tools can I use to build management reporting dashboards?

Management reporting dashboards can be built using Excel-based packs, accounting platform reports, or BI tools like Power BI, because the real success factor is consistent definitions, reconciled data, and role-based access—not the software brand alone.