Key Takeaways

Q1: What is “12 Facts: What Is an e invoicing form and Why It Matters for Tax Compliance” and why does it matter to SMEs, corporates, startups, and M&A teams?

An e invoicing form is a structured data-capture template used to collect buyer and transaction details needed for e-Invoice issuance and validation, strengthening tax compliance, audit evidence, and cross-entity governance for growing businesses.

Q2: How does an e invoicing form work in practice (fast answer)?

Finance teams collect verified identifiers (TIN, registration/NRIC), contact and address details, and tax profile inputs through an e invoicing form, then map them into invoicing systems or portals so submissions pass validation and reconcile cleanly.

Q3: What should the reader do next to reduce compliance risk?

Standardize your e invoicing form fields, validate master data against official documents, define ownership between Finance–Tax–IT, and align internal SOPs to LHDN guidance so issuance, consolidated invoices, and self-billed imports stay defensible.

An e invoicing form is quickly becoming a non-negotiable compliance building block for Malaysian businesses that want clean validation, defensible records, and fewer downstream tax disputes.

As e-Invoice adoption accelerates, many Finance and Tax teams discover that their biggest risk is not the portal or software—it is inconsistent buyer data, incomplete identifiers, and fragmented onboarding across suppliers, customers, and internal entities.

For SMEs, the operational reality is straightforward: one missing TIN, a mismatched registration number, or an incorrect address can trigger rejection, rework, and reconciliation delays that spill into month-end closing.

For large corporations and MNCs, the challenge compounds across shared services, multi-entity structures, and cross-border transactions.

For entrepreneurs and startups, the risk is building workflows too late, then scrambling to fix master data when invoices are already under scrutiny.

And for businesses undergoing restructuring or M&A, e-Invoice readiness becomes part of governance, due diligence, and post-merger integration.

Procheck Faculty Sdn Bhd—a 100% Bumiputera-owned professional services firm based in Putrajaya with over 25 years of experience—supports clients through regulatory complexity using tax advisory, accounting, corporate services, and business consulting.

Simplify Your Tax Management Today!

Partner with Procheck today to unlock your business’s full potential. Our team of experts is ready to help you navigate taxation challenges and achieve your strategic goals.

Request a Free Consultation

Get started with a no-obligation consultation to discover how we can transform your financial operations.

Clients often value the clarity and responsiveness of the team; as one customer shared

“Terbaikkk! Well explained, recommended.”

“Provides accounting, tax, audit, and company secretary services.”

This article breaks down 12 practical facts to help your organization design, govern, and operationalise an e invoicing form that stands up to compliance expectations and real-world execution.

What Is an e invoicing form in Malaysia’s e-Invoice Context

An e invoicing form is a structured data-capture template that collects buyer, seller, and transaction identifiers so an e-Invoice can be issued, validated, and defended as credible tax evidence under Malaysian compliance expectations.

What is an e-Invoice vs what is an e invoicing form

An e-Invoice is the validated digital invoice record submitted for IRBM/LHDNM validation, while an e invoicing form is the upstream master-data and transaction-data request that prevents rejection and reconciliation failures.

Which documents are covered (invoice, credit note, debit note)

In practice, the same identity and reference discipline applies across invoices, credit notes, and debit notes, because validation relies on consistent core fields (party identifiers, addresses, amounts, item/tax details) for audit-grade traceability.

Where the “form” fits in the workflow (data capture vs invoice issuance)

Operationally, the “form” sits before issuance—during onboarding or before billing—so Finance captures correct buyer identity (TIN/registration/NRIC), tax profile, and contact data once, then reuses it across billing cycles.

Why an e invoicing form Matters for Tax Compliance

When e-Invoice validation becomes the default, data quality becomes a compliance control, and an e invoicing form functions as your first-line defense against rejected submissions, weak audit trails, and disputed tax positions.

Why validated e-Invoices strengthen tax evidence and audit readiness

Validated e-Invoices include a unique identifier, timestamp, and verification mechanism, which materially improves evidentiary strength during tax audits, internal reviews, and dispute resolution compared to unvalidated invoice artefacts.

What changes when validation becomes the standard

Your invoice becomes “compliance-ready” only after validation, so any mismatch in party identity, address, or reference fields is no longer a back-office annoyance—it becomes a workflow blocker with operational cost.

Which compliance risks are reduced (incomplete data, mismatch, weak trails)

A disciplined form reduces: (1) incomplete buyer data, (2) mismatched identifiers across entities, (3) inconsistent address/contact fields, and (4) unclear documentation ownership that makes audits slow and outcomes uncertain.

E invoice implementation date

Implementation in Malaysia follows a phased timeline based on annual turnover, so the risk is not only “when you must comply,” but whether your internal data readiness will survive go-live without invoice disruption.

When e-Invoice becomes mandatory (phased rollout overview)

The official implementation timeline is published by LHDNM and staged by revenue bands, which means different SMEs, corporates, and group structures face different compliance deadlines and operational readiness windows.

Which business profiles are impacted at each phase

High-turnover corporates typically enter earlier phases, while smaller entities may enter later, but group structures and shared services often force earlier standardisation to avoid inconsistent billing controls across subsidiaries.

How to build a readiness timeline backwards from the go-live date

Work backwards in four tracks: (1) data mapping and form design, (2) master-data cleanup, (3) SOP ownership and approvals, and (4) controlled testing (portal/API), then lock a change-free window before go-live.

To support planning conversations, Procheck clients often reference E-Invoice Implementation Date when aligning Finance, Tax, and Operations around deadlines.

E invoice Guideline

Guidelines define the “rules of the road” for fields, scenarios, and workflow decisions, so treating them as an IT-only document is a common governance mistake that creates compliance exposure later.

What the guideline covers (scope, fields, workflow, scenarios)

The guidance outlines required data elements, submission/validation concepts, and scenario handling, which directly informs how you design an e invoicing form to capture the right identifiers at source.

Which areas create the most confusion (buyer identity, credit notes, exemptions)

Most confusion clusters around buyer identification rules (B2B vs B2C), credit/debit note referencing, and when simplified or consolidated approaches are permissible without undermining documentation quality.

How to translate guideline rules into internal SOPs

Convert rules into “if/then” SOP checkpoints (e.g., buyer type → required identifiers; transaction type → document references; exceptions → approvals), then train sales/admin teams so data is correct before Finance touches it.

LHDN E invoice Guideline PDF

The official PDFs are the baseline reference for compliance interpretation, and using them to build checklists is more reliable than relying on informal templates circulating between vendors and customers.

Which official PDFs are most referenced for implementation

Teams commonly rely on the Guideline, Specific Guideline, and FAQs, because these documents frame required fields, scenario logic, and validation outcomes in a way that is defensible during audits.

What to extract from the general FAQ document

Extract operational answers: what happens upon validation (unique identifier), how sharing/retention works, and practical clarifications that affect day-to-day workflows across billing, procurement, and record-keeping.

What to extract from the specific guideline document

Extract scenario rules: cross-border treatment, special transaction types, buyer identification handling, and field-level requirements that affect your onboarding forms and system validations.

How to convert PDF content into checklists and training modules

Turn each “required field” into a form field with validation rules, assign an owner (Finance/Tax/IT), and create a short internal quiz so non-finance staff understand why accuracy matters.

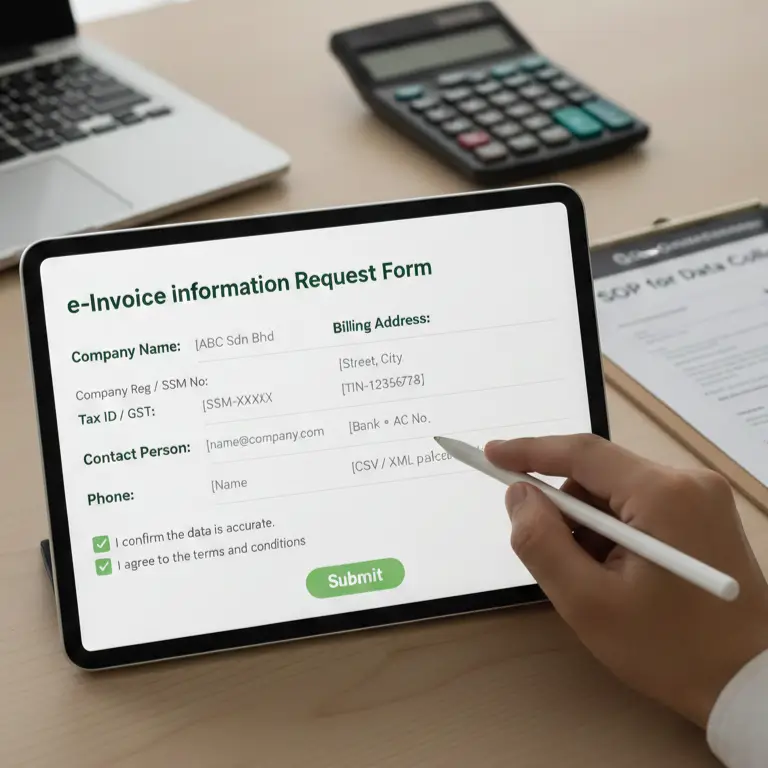

E invoice information request form

Suppliers request customer data because the issuer bears the operational burden of clean validation, and a well-designed e invoicing form reduces friction for both parties while improving compliance confidence.

Why suppliers require customers to complete an e invoicing form

Suppliers need verified buyer identifiers (such as TIN and registration/ID), tax profile context, and correct addresses so their e-Invoice submissions validate smoothly, reconcile into AR, and hold up under audit scrutiny.

What the supplier is trying to confirm (identity, TIN, tax profile)

They are confirming that your legal identity matches your master data, your tax identifiers are correct, and your invoicing details will not trigger rejection or disputes later when payments and tax reporting must align.

When customers must respond (vendor deadlines and cutovers)

Vendors typically run cutover dates before they enforce e-Invoice-only processes, so late responses can delay billing, disrupt procurement cycles, or force manual rework that becomes expensive at scale.

What fields belong in a compliant e invoicing form

A compliant e invoicing form should collect only what is necessary for validation and audit defense—identifiers, addresses, and contact points—while maintaining strict internal ownership to prevent uncontrolled edits.

e invoicing form field checklist for buyer and supplier master data

Use this practical checklist: legal name; registration/ID; TIN; SST (if applicable); address (registered + billing if different); country; email; phone; contact person; and internal reference (customer code/vendor code).

Which identifiers matter (company registration, NRIC/passport for individuals)

Corporate onboarding should anchor to SSM registration and TIN, while individuals may require NRIC/passport identifiers depending on the transaction context; the key is consistency with supporting documents.

What TIN and SST fields mean and when they apply

TIN supports identification for validation and traceability, while SST matters when your tax profile influences invoicing treatment; treat these as controlled master-data fields, not free-text entries.

What address, email, phone, and contact person fields should contain

Use an address that matches legal/registered records where required, a monitored finance email for invoice delivery and disputes, and a named owner to prevent “shared mailbox” confusion during audits.

Which common mistakes cause rework (typos, mismatch, missing mandatory fields)

The most common failures are inconsistent legal names, old addresses, swapped registration numbers, missing TIN, and uncontrolled edits by sales/admin staff that conflict with Finance master data.

Examples of real-world e invoicing form patterns used by companies

Companies typically use one of three patterns—B2B data collection forms, PDF templates, or web portals—because each pattern solves a different operational need for speed, control, and auditability.

Data collection form (B2B vendor onboarding)

Best for recurring B2B billing where you need controlled fields, approvals, and traceable updates.

PDF form aligned to compulsory data requirements

Useful when your counterparty requires a standard template, but it should be backed by internal validation before master data is updated.

Webform / portal request for consumer e-Invoice

Suitable for B2C settings where buyers request e-Invoices, but it must still enforce identity rules and data completeness.

Which format fits which business model

SMEs often start with a controlled form + spreadsheet governance, corporates move toward system validations and API integration, and consumer brands prefer portals to handle request volume and reduce manual handling.

For broader compliance context, many Finance teams also review Tax System in Malaysia to align e-Invoice workflows with their overall statutory reporting discipline.

Consolidated e invoice

A consolidated e-Invoice reduces issuance overhead for high-volume retail-like transactions, but it demands stronger underlying documentation control because auditors will still expect a defensible trail behind the consolidated totals.

What is a consolidated e-Invoice and when it is permitted

A consolidated e-Invoice aggregates multiple transactions into one submission under permissible conditions, helping operational teams reduce volume while still meeting near real-time reporting objectives set by LHDNM.

Which transaction types are typically consolidated (non-identified buyers, retail)

Commonly used where buyer identification is not captured per transaction, such as certain consumer-facing sales, provided internal records can substantiate the aggregated amounts.

How to keep underlying sales records defensible for audits

Keep daily transaction logs, POS summaries, returns/adjustments mapping, and a clear month-end reconciliation pack so consolidated submissions are explainable without scrambling during audit queries.

How the e invoicing form Supports Imported Goods & Services (Cross-border)

Cross-border scenarios often require “self-billed” handling, and an e invoicing form helps you capture foreign supplier identity, reference documents, and internal approvals so the import expense remains defensible.

What “self-billed e-Invoice” means and why it applies to imports

A self-billed e-Invoice is issued by the Malaysian buyer on behalf of a supplier (often a non-resident) to document imports properly, supporting validation and compliant expense substantiation.

How to handle import of goods (required references and documents)

Capture supplier name and country, customs clearance references, shipment documents, and invoice/packing list references so the transaction can be supported consistently across Finance, Tax, and Customs files.

How to handle import of services (documentation and tax logic)

Document the service agreement, scope period, payment references, and internal approvals, because the audit question is usually “what was received and why is it deductible,” not merely the payment trail.

Which pitfalls are common (supplier identity fields, inconsistent references)

Typical pitfalls include inconsistent supplier naming, missing contract references, and unclear responsibility between procurement and finance, which creates avoidable rework when transaction volume increases.

Validation, QR Code, and Audit Evidence After Submission

After submission, validation produces traceable identifiers and verification mechanisms, and that validated output becomes the artefact you should retain to defend revenue recognition, expense substantiation, and tax positions.

What “validated e-Invoice” means (unique ID, timestamp, traceability)

Validation means LHDNM assigns a unique identifier and records the validation time, enabling verifiable traceability that strengthens audit evidence and supports consistent reconciliation across AR/AP and tax reporting.

How QR verification supports downstream checks

QR verification helps internal auditors, buyers, and suppliers confirm invoice authenticity and status quickly, which reduces disputes and accelerates resolution when billing details are challenged.

What to retain for audit defense (records, attachments, system logs)

Retain: validated invoice output, submission logs, approvals, supporting documents (contracts, delivery evidence), and a reconciliation pack linking transactions to accounting entries.

Data Governance and Internal Controls for e invoicing form Collection

Governance determines whether your e invoicing form remains a controlled compliance asset or becomes an uncontrolled spreadsheet risk, so ownership, approvals, and versioning should be treated as part of your internal control environment.

Why data protection and confidentiality matter when collecting customer data

Request forms often contain regulated personal identifiers and business details, so data minimisation, access control, and retention rules help maintain PDPA-aligned handling while protecting client trust and reducing breach exposure.

Who should own the process (Finance, Tax, IT) and approval flow design

A practical model is: Finance owns master data, Tax owns compliance interpretation, IT owns system validation rules, and business units own first-pass data capture with mandatory Finance approval before changes go live.

How to manage change control (template updates, field mapping, versioning)

Implement a versioned form, a single source of truth for master data, and a change log that records who changed what and why—especially critical for corporates, MNCs, and M&A integration scenarios.

Implementation Checklist by Business Type

Different business profiles face different operational constraints, so implementation should be tailored to transaction volume, system maturity, and governance needs while keeping the e invoicing form as the consistent foundation.

How SMEs can start with a minimal but compliant approach

SMEs can move fast by standardising a single e invoicing form template, validating buyer identifiers against documents, and assigning clear ownership to prevent uncontrolled edits that trigger submission failures later.

Which operating model to choose (portal/manual vs system/API)

Use portal/manual for low volume and early learning, then migrate to system integration once transaction volume or multi-entity complexity makes manual controls costly.

How to run vendor/customer onboarding using an e invoicing form

Start with a controlled form, require document proof (SSM, TIN confirmation), and route updates through Finance approval before applying changes to billing master data.

How corporates and MNCs standardize across entities and regions

Corporates succeed when they centralise master data governance, enforce validation rules, and align shared services to one operating model, preventing different subsidiaries from collecting inconsistent identifiers that fail group-wide reconciliation.

Which controls support scale (master data, validation rules, governance)

Key controls include master data stewardship, mandatory field validations, change approval matrices, and periodic data quality reviews tied to month-end close.

How to prepare shared services and multi-entity reporting

Define a common data dictionary, enforce entity-to-entity invoicing rules, and create a group-level exception process so local teams cannot “shortcut” compliance under operational pressure.

How startups, reorganizations, and M&A teams avoid disruptions

Startups and transformation teams should treat e-Invoice readiness as a governance workstream, because entity changes, system migrations, and policy changes can break invoicing continuity if form design and ownership are unclear.

Which due diligence items relate to e-Invoicing readiness

Review master data completeness, invoicing workflows, system capability (portal vs API), and documentation discipline, because these items affect post-deal integration risk and financial reporting stability.

How to fix process gaps without delaying go-live

Prioritise a minimum viable compliant form, lock a controlled change process, and phase enhancements after stable issuance is achieved rather than attempting a “perfect system” before the deadline.

How Procheck Tax Services Supports e-Invoicing Readiness

For regulated, high-stakes environments, advisory support helps translate guidelines into operational controls, ensuring your e invoicing form, workflows, and evidence packs remain defensible during audits, restructuring, and M&A reviews.

What advisory support typically includes (interpretation, controls, SOPs)

Advisory support typically covers guideline interpretation, field mapping, SOP design, data governance, and audit-ready documentation practices so Finance–Tax–IT alignment is built before validation failures occur.

Which deliverables clients usually need (readiness assessment, templates, review)

Common deliverables include readiness diagnostics, e invoicing form templates, master-data cleanup plans, approval matrices, training modules, and periodic compliance reviews once issuance begins.

How to reduce compliance risk during audits and organizational change

Risk is reduced by controlling data ownership, maintaining a clear evidence trail, standardising across entities, and ensuring validation outcomes and reconciliations are documented in a repeatable monthly pack.

A well-governed e invoicing form is not administrative overhead—it is a practical compliance control that protects invoice validation outcomes, supports audit defensibility, and reduces operational friction across Finance, Tax, and Operations.

For SMEs, corporates, startups, and M&A teams, the priority is consistent identifiers, documented ownership, and a repeatable evidence pack that aligns with LHDNM guidance.

If your team wants to operationalise e-Invoice compliance with fewer rejections and cleaner audit trails, explore Procheck’s Tax Services for structured support on governance, documentation, and validation-ready workflows. For related guidance, browse tax tips compliance and standardise your internal playbooks before volume and complexity increase.

FAQ

What is an e invoicing form and who should own it internally?

An e invoicing form should be owned by Finance as the master data steward, with Tax approving compliance interpretations and IT enforcing system validation rules, because uncontrolled edits create submission failures and audit risk.

Can SMEs start with a manual portal approach before system integration?

Yes, SMEs can start with portal/manual issuance if they standardise master data and onboarding controls first, because validation outcomes depend more on identity accuracy and document referencing than on the sophistication of the software.

What data points most commonly cause e-Invoice validation rejection?

Validation issues commonly stem from incorrect TINs, mismatched legal entity names, outdated addresses, missing mandatory identifiers, and inconsistent reference fields across credit notes, debit notes, and original invoices.

How long should we retain validated e-Invoice evidence and supporting documents?

Retention should align to your statutory record-keeping obligations and internal audit policy, but best practice is to retain validated outputs, submission logs, approvals, and supporting documents as a single reconciled evidence pack.