Why CP22A Is Crucial for Companies with High Staff Turnover

Key Takeaways Q1: What is CP22A and why does it matter to Malaysian businesses with high staff turnover? A: CP22A

Key Takeaways Q1: What is CP22A and why does it matter to Malaysian businesses with high staff turnover? A: CP22A

Key Takeaways (Q & A) Q: What is “Does Your Company Have to Issue CP58 When Incentives > RM 5,000?

Beneficial ownership SSM has become one of the most critical compliance requirements for Sendirian Berhad (Sdn Bhd) companies in Malaysia.

The e-invoice implementation date in Malaysia is one of the most critical regulatory changes businesses must prepare for, as confirmed

✅ Top 3 Key Takeaways The 8 high-risk mistakes are costly. In a book of accounts, missing source documents, expense–asset

✅ Top 3 Key Takeaways Master the core 5 rules. Anchor every entry to Assets = Liabilities + Equity, apply

✅ Top 3 Key Takeaways What is Withholding tax in Malaysia? It is a tax deducted at source from payments

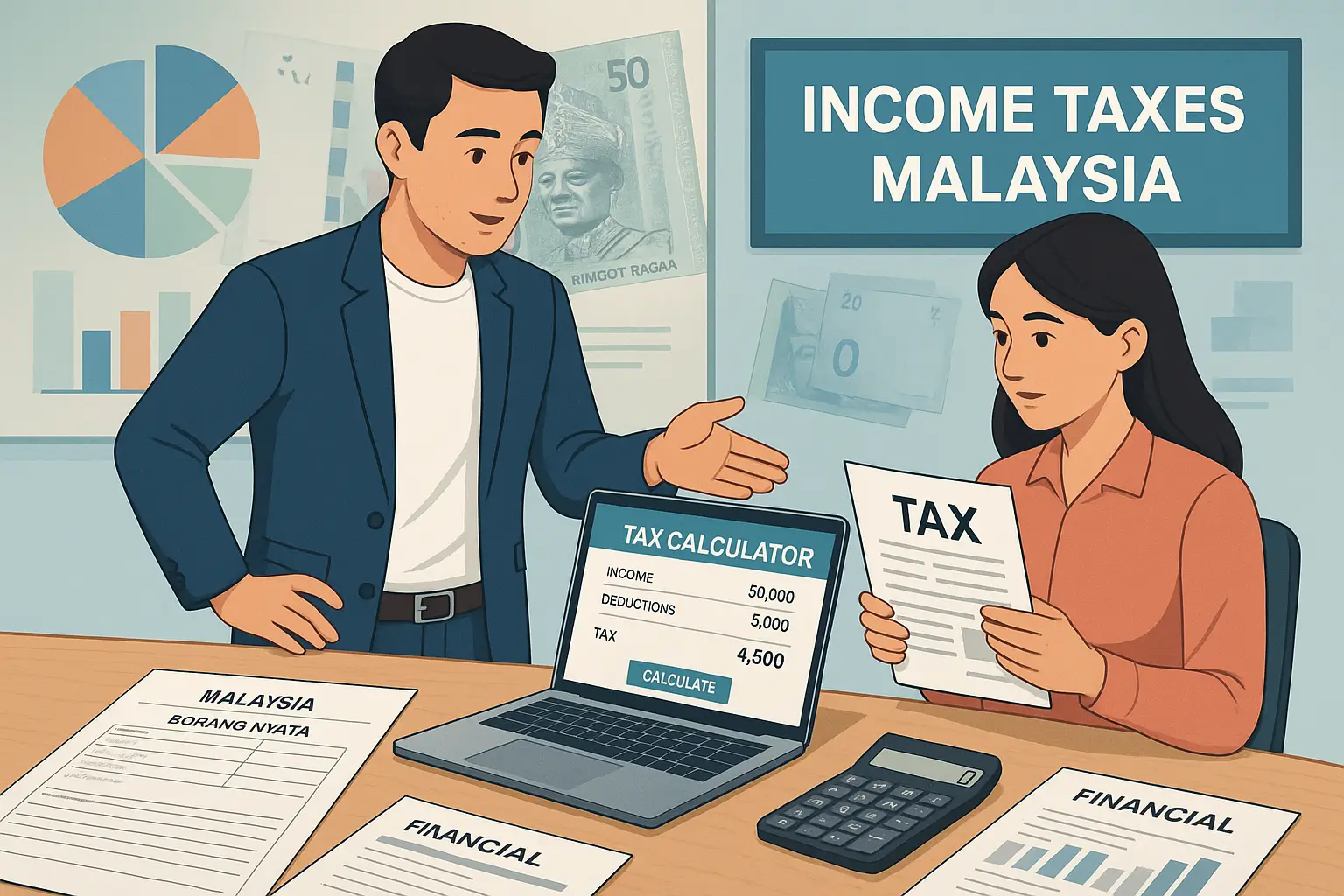

✅ Top 3 Key Takeaways Income taxes Malaysia for individuals are calculated based on tax residency status, chargeable income after

✅ Top 3 Key Takeaways ✅ Top 3 Key Takeaways Accepted Answers Vote () Accepted Answers Always confirm an accounting

A comprehensive income statement format provides businesses with a broader financial perspective beyond net income. It includes realized and unrealized