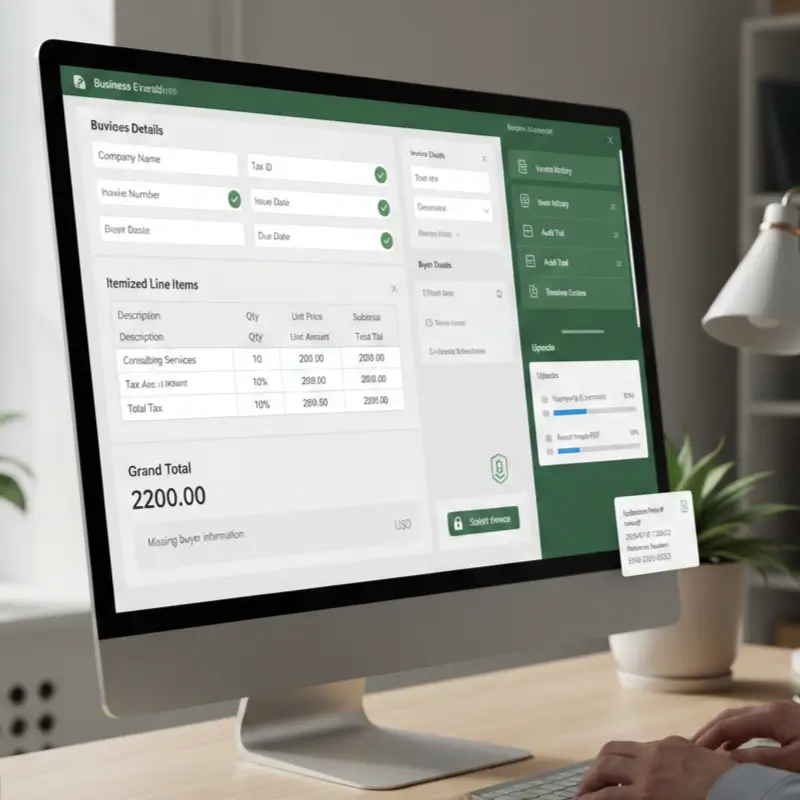

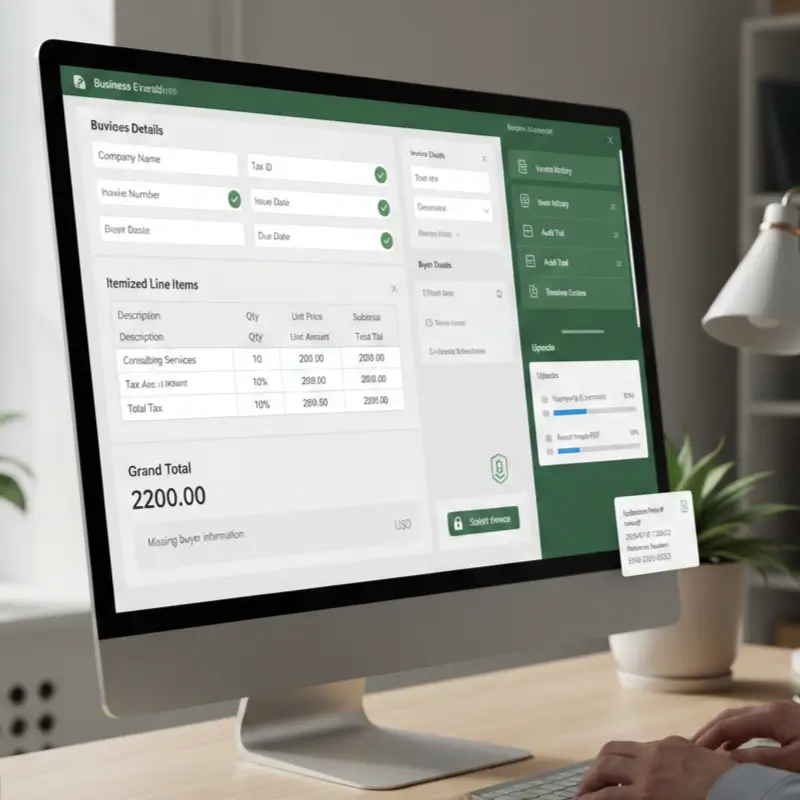

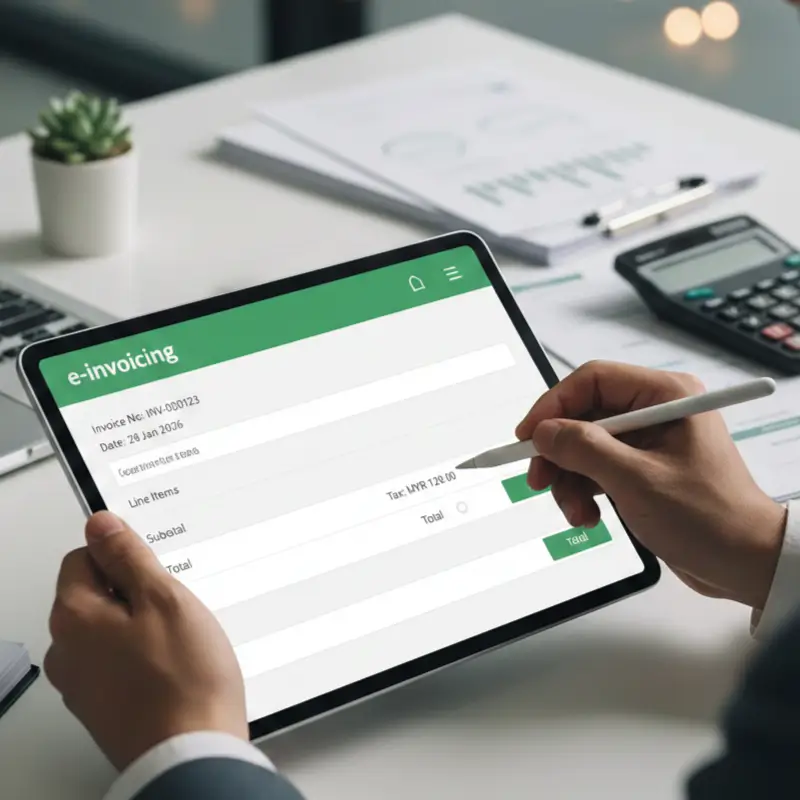

8 Steps: How Do You Create an e invoicing sample That Passes Tax Review

Key Takeaways Q1: What is “8 Steps: How Do You Create an e invoicing sample That Passes Tax Review,” and

Key Takeaways Q1: What is “8 Steps: How Do You Create an e invoicing sample That Passes Tax Review,” and

Key Takeaways Q1: What is “12 Facts: What Is an e invoicing form and Why It Matters for Tax Compliance”

Key Takeaways (Q&A) Q1: What is management reporting, and why is it 7 times more useful than financial statements for

Key Takeaways (Q&A) Q1: What does “What Are 7 Key Minimum Wage Malaysia Updates Employers Must Prepare for This Year?”

Key Takeaway What is “Why CP204 Matters for Businesses and 20 Key Facts You Should Not Overlook” and why it

Key Takeaways Q1: What is “12 Reasons Why a Tax Calculator Income Guide Matters for Corporate Tax Planning” and why

Key Takeaways Q1: What is CP22A and why does it matter to Malaysian businesses with high staff turnover? A: CP22A

Key Takeaways (Q & A) Q: What is “Does Your Company Have to Issue CP58 When Incentives > RM 5,000?

Beneficial ownership SSM has become one of the most critical compliance requirements for Sendirian Berhad (Sdn Bhd) companies in Malaysia.

The e-invoice implementation date in Malaysia is one of the most critical regulatory changes businesses must prepare for, as confirmed