3 Key Takeaways

- Understanding the Sdn Bhd structure helps you make smarter business decisions from the start.

- Legal, financial, and tax compliance planning are critical before incorporating a Sdn Bhd.

- Procheck’s expert services ensure your First Plan Sdn Bhd journey is smooth, compliant, and growth-ready.

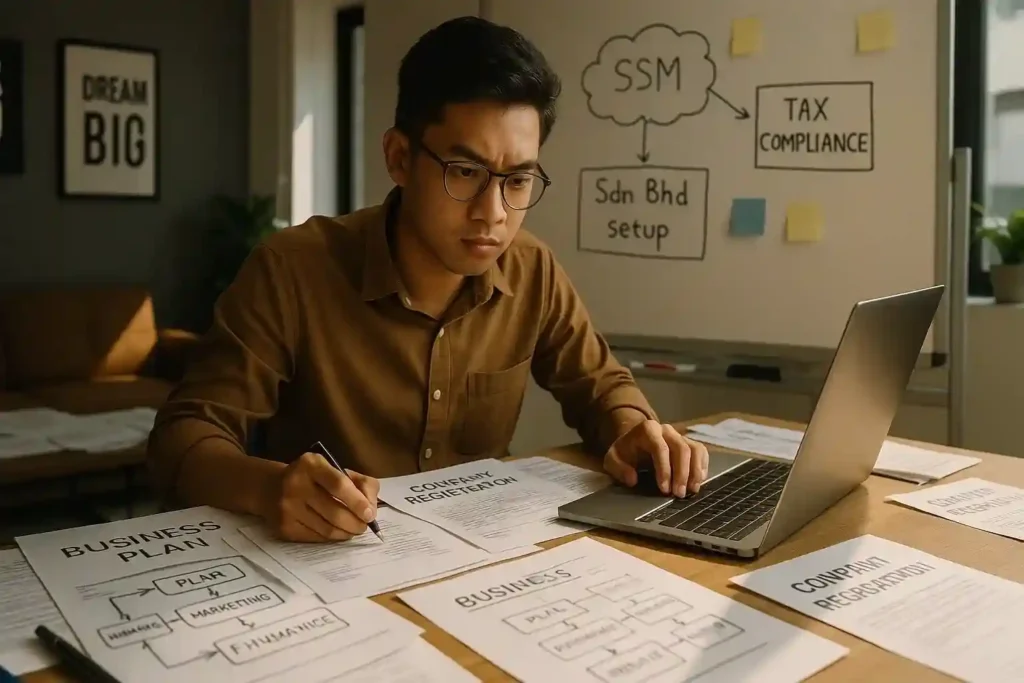

Starting your First Plan Sdn Bhd can be one of the most rewarding moves you make as an entrepreneur or business leader—but it also comes with a series of legal, financial, and compliance responsibilities that must be addressed with care.

Whether you’re a startup founder eager to scale, a growing SME seeking structure, or a multinational expanding into Malaysia, setting up a Sdn Bhd (Sendirian Berhad) involves more than just registering a company name.

Simplify Your Tax Management Today!

Partner with Procheck today to unlock your business’s full potential. Our team of experts is ready to help you navigate taxation challenges and achieve your strategic goals.

Request a Free Consultation

Get started with a no-obligation consultation to discover how we can transform your financial operations.

Many first-time business owners underestimate the complexities of incorporating a private limited company in Malaysia.

While a Sdn Bhd structure offers several advantages—such as limited liability protection, improved credibility, and better access to funding—it also places specific duties on directors, shareholders, and company secretaries.

Without a solid understanding of these requirements, companies risk non-compliance, tax penalties, and even operational disruptions.

This article walks you through the 10 key things you need to know before you start your First Plan Sdn Bhd—from selecting the right business name and preparing your incorporation documents, to understanding your tax obligations and setting up sound financial systems.

With over 25 years of experience in the professional services industry, Procheck Faculty Sdn Bhd has supported thousands of businesses through these foundational steps—ensuring full compliance with regulatory bodies like SSM (Suruhanjaya Syarikat Malaysia) and LHDN (Lembaga Hasil Dalam Negeri).

Each section of this guide is designed to address the most common pain points faced by SMEs, large corporations, startups, and M&A-driven entities alike.

Whether you’re planning your first company or restructuring an existing business, these tips will help you turn that first plan into a strong foundation for sustainable growth.

Let’s explore the strategic and compliance-focused checklist that every business leader must consider before launching their First Plan Sdn Bhd—backed by actionable insights, proven best practices, and expert recommendations from Procheck.

What Are the 10 Key Things to Know Before Starting Your First Plan Sdn Bhd?

1. Understand the Sdn Bhd Structure and Its Advantages

A Sdn Bhd is a private limited company recognized as a separate legal entity under Malaysian law.

It offers distinct advantages:

- Limited liability: Shareholders are only liable up to their share capital.

- Corporate credibility: Preferred by banks, investors, and clients.

- Continuity: Ownership can change without affecting operations.

This structure is ideal for startups, SMEs, and companies looking to scale without personal financial exposure.

2. Determine the Right Time to Incorporate a Sdn Bhd

Timing is key.

Consider incorporating your First Plan Sdn Bhd when:

- You are ready to hire staff or seek funding.

- You want to protect your personal assets.

- Your business is expanding and needs structure.

Early incorporation avoids potential penalties from operating as a sole proprietor under the wrong business model, and addresses common questions such as “can sole proprietor change owner Malaysia” before converting into a First Plan Sdn Bhd.

3. Meet the Legal Requirements for Incorporation

To legally form a Sdn Bhd, you’ll need:

- At least one director and one shareholder (can be the same person).

- A qualified company secretary licensed by SSM.

- A registered office address in Malaysia.

“Perkhidmatan Setiausaha Syarikat dari Procheck sangat profesional dan cekap. Mereka membantu saya menguruskan dokumentasi syarikat dengan teliti dan memastikan pematuhan undang-undang.”

Noor Ariffshah

4. Choose an Appropriate Business Name and Conduct a Name Search

A unique, relevant name reflects your brand and affects legal approval.

Consider:

- Avoiding sensitive or restricted words.

- Performing a name search via MyCoID portal.

- Preparing alternate names in case of rejection.

5. Prepare the Necessary Documentation for Registration

Essential documents for your First Plan Sdn Bhd include:

- Company Constitution (optional but recommended)

- Details of directors and shareholders

- Declaration of compliance (Form 48A)

- Consent to act as director

Procheck simplifies this process by handling all submissions through the MyCoID system.

6. Register Your Business and Obtain Necessary Licenses

Post-approval, you must register with SSM and apply for:

- Sector-specific permits (F&B, logistics, etc.)

- Local council approvals

- Halal, MESTI, or import/export licenses (if applicable)

7. Understand Your Tax Obligations and Register with LHDN

Your First Plan Sdn Bhd must:

- Register with LHDN for corporate tax and employer tax.

- Submit Form CP204 (estimate of tax payable).

- Assess if SST or Withholding Tax applies to your business.

“Procheck helped us organize and file our tax documentation. They made corporate taxation clear and easy.”

Hans Empire

8. Set Up Proper Accounting and Record-Keeping Systems

Compliant financial records are mandatory.

Implement:

- Cloud-based accounting software

- Monthly bookkeeping with internal controls

- Annual audit preparation and statutory filing

Procheck offers comprehensive accounting advisory and internal control audits.

9. Secure Adequate Funding and Manage Cash Flow

Before launching, ensure:

- Initial paid-up capital is sufficient.

- You have a cash flow plan for the next 12 months.

- Explore SME loans, grants, or angel investors.

Proper funding avoids operational hiccups and enables stability in your First Plan Sdn Bhd’s early months.

10. Plan for Business Growth and Compliance

Growth is more manageable with:

- A defined business structure

- Strategic SOPs and KPI tracking

- Long-term compliance calendar for tax, filings, licenses

Procheck’s business consulting team can assist with change management and proposal development to support scalable growth.

Key Benefits of Understanding These 10 Things for Your First Plan Sdn Bhd

Why This Knowledge Matters for Procheck's Diverse Clients

Whether you’re an SME or a multinational, these 10 essentials help you:

- Avoid costly legal mistakes

- Position your business for investment

- Save time on trial-and-error setups

How Procheck Positions Your First Plan Sdn Bhd for Success

With 25+ years of experience, Procheck:

- Ensures full compliance with Malaysian regulations

- Provides tailored support for SMEs, startups, and MNCs

- Offers a one-stop solution for tax, accounts, secretarial, and business advisory

Additional Factors to Consider

- Appoint a licensed company secretary from day one

- Monitor changes in government regulations (especially tax)

- Leverage digital tools for faster business decisions

Common Challenges in Setting Up a First Plan Sdn Bhd

What Are the Biggest Obstacles?

- Submitting incorrect or incomplete documentation when setting up a sdn company

- Not registering for tax early

- Confusion over statutory requirements

How to Overcome These Challenges

- Engage professionals like Procheck

- Use digital filing systems for consistency

- Set up automatic reminders for key deadlines

Best Practices for First-Time Sdn Bhd Owners of a Sdn Company

How to Document Your First Plan for Long-Term Growth

- Always keep business and personal finances separate

- Invest in digital systems from the start

- Schedule quarterly reviews of tax and compliance

Tools & Resources That Help

- MyCoID and EzBiz (SSM tools)

- Accounting platforms like AutoCount or Xero

- Procheck’s consulting and internal audit services

- Aligning Your 1st Plan With Long-Term Compliance

Laying the Right Foundation for Your Sdn Bhd Journey

Starting your First Plan Sdn Bhd is more than just paperwork—it’s about turning your 1st plan into a solid, compliant, and future-ready foundation for your business.

From understanding legal structures to mastering tax obligations and financial planning, each of the 10 steps discussed in this article plays a vital role in shaping your company’s success.

By getting the basics right from the beginning, you save time, avoid costly mistakes, and open the door to sustainable growth.

Ready to incorporate your First Plan Sdn Bhd with confidence? Let Procheck Faculty Sdn Bhd be your trusted partner.

With over 25 years of experience, our team offers professional support in company formation, taxation, accounting advisory, and corporate compliance.

📞 Whatsapp now for consultation today and take the first step toward a structured and strategic business journey.

Whether you’re a startup, SME, or expanding enterprise—we’re here to guide you every step of the way.

Frequently Asked Questions (FAQ)

1. What is the first step in starting my First Plan Sdn Bhd?

The first step in starting your First Plan Sdn Bhd is to understand the Sdn Bhd business structure and its legal implications.

Then, appoint at least one director and a licensed company secretary before submitting incorporation documents through the MyCoID system.

2. Do I need a company secretary to set up my First Plan Sdn Bhd?

Yes, every First Plan Sdn Bhd must appoint a qualified company secretary within 30 days of incorporation, as required by the Companies Act 2016.

This ensures proper statutory compliance and corporate governance.

3. What taxes must my First Plan Sdn Bhd register for in Malaysia?

Your First Plan Sdn Bhd must register with LHDN for corporate income tax, employer tax (if hiring), and SST if applicable.

You’ll also need to submit Form CP204 within 3 months of your financial year start.

4. How can Procheck help manage my First Plan Sdn Bhd’s compliance?

Procheck provides end-to-end support for your First Plan Sdn Bhd, including company secretarial services, tax registration, accounting advisory, and compliance reporting—ensuring you meet all regulatory requirements efficiently.

5. What documents are needed to incorporate a First Plan Sdn Bhd?

To incorporate your First Plan Sdn Bhd, you’ll need directors’ details, a business address, share capital declaration, consent letters, and optionally a company constitution.

Procheck can assist in preparing and filing these accurately.

6. Can sole proprietor change owner Malaysia before converting to a First Plan Sdn Bhd?

Many founders ask whether a sole proprietor can change owner in Malaysia before they incorporate. While ownership changes are possible, it is usually more efficient to plan your conversion into a First Plan Sdn Bhd early so that governance, tax, and compliance for the new entity are clear from day one.