Key Takeaways

Q1: What is “8 Steps: How Do You Create an e invoicing sample That Passes Tax Review,” and why does it matter to Malaysian businesses?

A: It is a structured compliance framework that helps SMEs, corporates, startups, and M&A-driven entities prepare an e invoicing sample aligned with LHDN MyInvois requirements, reducing rejection risk, audit exposure, and downstream tax penalties.

Q2: How does creating a compliant e invoicing sample work in practice?

A: Businesses follow eight practical steps covering invoice model selection, mandatory data field completion, schema validation, testing, and audit-trail retention, ensuring each e invoicing sample is technically valid, traceable, and tax-review ready.

Q3: What should you do next after understanding these 8 steps?

A: You should assess your current invoicing process, test a sample against MyInvois validation rules, and engage a professional tax advisor like Procheck to review compliance, optimise reporting, and support smooth implementation.

An e invoicing sample is no longer just a technical document for IT teams—it is now a critical compliance artefact that directly affects tax accuracy, audit readiness, and regulatory confidence for Malaysian businesses.

With the rollout of LHDN’s MyInvois framework, companies that fail to prepare proper sample invoices risk rejection, delays, and increased scrutiny during tax reviews.

For SMEs, large corporations, startups, and entities involved in restructuring or M&A, e-invoicing sits at the intersection of accounting systems, tax regulations, and operational workflows.

This is where many businesses struggle—not because they lack software, but because their sample invoices do not fully align with mandatory data fields, correct invoice models, or audit-trail expectations imposed by the Inland Revenue Board of Malaysia (LHDN).

Procheck Faculty Sdn Bhd, a 100% Bumiputera-owned professional services firm based in Putrajaya, brings over 25 years of experience in taxation, accounting advisory, corporate services, and business consulting to help organisations navigate exactly these challenges.

Simplify Your Tax Management Today!

Partner with Procheck today to unlock your business’s full potential. Our team of experts is ready to help you navigate taxation challenges and achieve your strategic goals.

Request a Free Consultation

Get started with a no-obligation consultation to discover how we can transform your financial operations.

From tax compliance reviews to due diligence during mergers and acquisitions, Procheck routinely assesses whether financial documentation—including e-invoice samples—can withstand regulatory and audit examination.

Client feedback consistently reflects this depth of expertise.

“Perkhidmatan Setiausaha Syarikat dari Procheck sangat profesional dan cekap… memastikan pematuhan undang-undang.”

Noor Ariffshah

Others echo similar trust, describing Procheck as

“well explained, recommended” and “provides accounting, tax, audit, and company secretary services.”

This credibility matters when e-invoicing errors can trigger compliance risks across income tax, withholding tax, and statutory reporting.

In this guide, we break down 8 practical, regulator-aligned steps to help you create an e invoicing sample that passes tax review with confidence.

Whether you are preparing for initial implementation, system integration, or an upcoming audit, this article translates regulatory complexity into actionable guidance grounded in real-world Malaysian business practice.

Quick overview — What is an e invoicing sample and why it matters

An e invoicing sample is a structured digital invoice file used to test, validate, and demonstrate compliance with LHDN MyInvois requirements, ensuring transaction data is accurate, complete, and review-ready before live submission.

An e invoicing sample serves as a controlled reference point for finance, tax, and system teams to confirm that invoice data flows correctly from accounting records into the MyInvois ecosystem, supporting broader compliance under the Malaysian tax system in Malaysia.

For SMEs and startups, it reduces costly trial-and-error during go-live. For large corporations and MNCs, it supports consistency across entities, branches, and ERP systems.

In M&A or restructuring scenarios, a validated sample helps demonstrate historical compliance and data integrity during due diligence reviews.

Definition and file formats (XML and JSON)

An e invoicing sample is typically created in XML or JSON format, following LHDN’s published schema to ensure machine-readability, standardisation, and automated validation within the MyInvois platform.

XML is commonly preferred by enterprises with ERP integrations, while JSON is widely used by modern accounting software and API-based systems. Regardless of format, both require strict adherence to field names, data types, and hierarchical structure.

A single misplaced tag or missing value can cause rejection, making early sample testing essential.

Who needs an e invoicing sample

Every entity issuing invoices in Malaysia—including SMEs, large corporations, startups, and businesses involved in mergers or organisational changes—must prepare an e invoicing sample to validate compliance before full implementation, especially in line with the official E-Invoice Implementation Date.

For growing businesses, a sample clarifies internal responsibilities between finance and operations.

For corporations, it ensures standardisation across multiple subsidiaries.

For M&A transactions, sample invoices help advisors assess post-acquisition compliance risks and integration readiness.

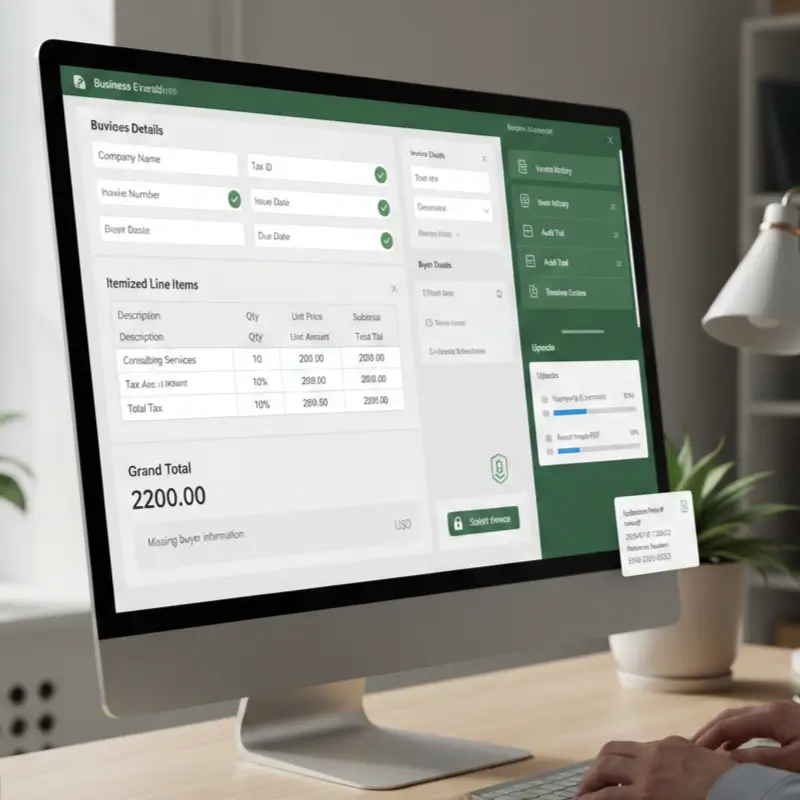

Must-have fields — The 51 mandatory data fields explained (e invoicing sample)

The 51 mandatory data fields form the compliance backbone of every e invoicing sample, ensuring LHDN can accurately identify parties, transaction values, tax treatments, and audit trails.

These fields are not arbitrary; they are designed to standardise invoicing data nationwide while enabling automated validation and analytics.

Missing or incorrectly populated fields are among the most common causes of invoice rejection during testing and live submission.

The 9 sections those fields fall into

Mandatory fields are grouped into nine logical sections, including supplier details, buyer details, invoice header, line items, tax breakdowns, payment information, and unique identifiers.

This structure mirrors standard accounting practices, making it easier to map data from accounting ledgers into the e-invoice format and align reporting with income taxes Malaysia.

Businesses that align their chart of accounts and customer master data early experience far fewer issues during validation.

Field examples and mapping to accounting records

Each field in an e invoicing sample should trace directly back to accounting records, such as customer master files, sales journals, and tax codes.

For example, supplier tax identification numbers must match LHDN records exactly, while line-item totals must reconcile mathematically with tax calculations and invoice totals.

This alignment is critical during tax audits, where inconsistencies often trigger further review.

How to format unique identifiers and tax codes

Unique invoice numbers, tax types, and currency codes must follow prescribed formats to ensure system recognition and traceability.

Consistent identifier logic across accounting systems, invoicing software, and MyInvois submissions helps reduce duplication, mismatches, and audit flags—particularly for high-volume or multi-entity businesses.

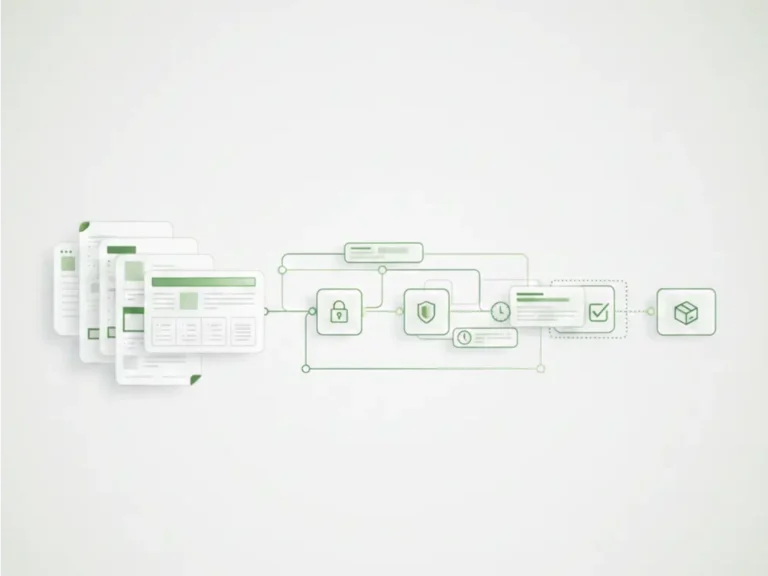

8-step checklist to create an e invoicing sample that passes tax review

Following a structured, step-by-step approach ensures your e invoicing sample meets technical, tax, and audit expectations without unnecessary rework or compliance risk.

Step 1 — Choose your e-invoice model

Selecting the correct model—MyInvois Portal, API integration, or consolidated buyer model—determines how data flows, who submits invoices, and how validation occurs.

SMEs often start with the portal for simplicity, while larger organisations prefer API-based automation. Buyer-side consolidation may apply in specific scenarios and must be carefully justified.

Step 2 — Select the correct invoice type

Choosing between standard invoices, self-billed invoices, consolidated invoices, or credit and debit notes ensures transactions are categorised correctly for tax purposes.

Using the wrong invoice type can misstate revenue timing, tax liability, or expense recognition, leading to downstream compliance issues linked to tax auditing.

Step 3 — Populate the 51 mandatory fields accurately

Every mandatory field must be completed using validated source data to avoid rejection during schema validation or tax review.

This step requires close coordination between finance, tax, and IT teams to ensure accuracy, consistency, and completeness.

Step 4 — Use the correct schema and file format

Applying the correct Invoice version and schema ensures compatibility with MyInvois validation rules and future system updates.

Testing samples against the latest schema reduces the risk of unexpected failures during live submission.

Step 5 — Validate digital integrity and timestamps

Validation checks ensure invoice data has not been altered and reflects the correct transaction timing.

Accurate timestamps are particularly important for revenue recognition, tax period allocation, and audit traceability.

Step 6 — Test and reconcile with accounting reports

Reconciling sample invoices with accounting and reporting outputs ensures totals, taxes, and balances match financial records.

This step is crucial for businesses subject to periodic tax audits or financial statement reviews.

Step 7 — Complete pre-submission checks

Final checks should cover attachments, currency handling, multi-line items, and consolidation rules before submission.

A standardised checklist significantly reduces avoidable errors and rejections.

Step 8 — Submit and retain audit evidence

Once validated, invoices should be submitted and stored with supporting documentation for statutory retention.

Proper record-keeping supports future audits, due diligence exercises, and internal reviews.

Templates & practical examples (e invoicing sample)

Using real-world templates accelerates learning and helps teams understand how theoretical requirements translate into actual invoice files.

Templates also provide a baseline for consistency across departments, branches, and systems.

XML and JSON sample payloads

Sample payloads illustrate correct field placement, hierarchy, and data formatting for both XML and JSON structures.

Adapting these samples to your business context helps identify data gaps early in the implementation process.

Self-billed and consolidated invoice examples

Self-billed and consolidated scenarios require additional care due to role reversals and aggregation logic.

Understanding these examples helps businesses avoid misclassification and compliance errors.

Integration & software — e invoice software malaysia

Choosing the right e invoice software malaysia solution directly affects data accuracy, scalability, and long-term compliance.

Software should support schema updates, validation tools, reporting, and integration with existing accounting systems.

Portal vs API vs third-party software

Each option offers different trade-offs between cost, automation, control, and scalability.

Selecting the right approach depends on transaction volume, organisational complexity, and internal capabilities.

Testing software compatibility

Testing ensures generated invoices align with MyInvois schemas and validation rules.

Early testing prevents costly system rework closer to go-live.

Recommended outputs from software testing

Validated sample invoices, reconciliation reports, and error logs provide evidence of readiness and support audit requirements.

Validation & submission — How to avoid common errors

Most e-invoice rejections stem from avoidable issues such as missing fields, incorrect formats, or mismatched totals.

Systematic validation and peer review dramatically reduce these risks.

Common mistakes and fixes

Typical errors include incorrect tax codes, inconsistent identifiers, and rounding discrepancies.

Addressing these issues at the sample stage prevents repeated failures during live submission.

Validation workflow

A structured workflow combining automated schema checks and manual reviews ensures both technical and tax accuracy.

Sample validation checklist

Using a standard checklist promotes consistency and accountability across teams.

Reporting & audit trail — Prepare your files for tax review and audits

A compliant e invoicing sample must be supported by a clear audit trail that links invoices to contracts, delivery records, and accounting entries.

This linkage is critical during tax audits and financial reviews.

Supporting documents

Documents such as delivery notes, contracts, and data collection forms strengthen audit defensibility.

Reporting and retention

Regular reporting and proper record retention support compliance with statutory requirements.

Retention best practices

Clear retention policies reduce risk and simplify future reviews.

Next steps — Implementation checklist for SMEs & finance teams

Successful implementation requires planning, ownership, and ongoing monitoring beyond initial sample creation.

A structured rollout checklist ensures long-term compliance and operational efficiency.

When to engage professional advisors

Engaging experienced tax and accounting advisors adds assurance, especially for complex structures, cross-border transactions, or M&A scenarios.

This support helps ensure your e invoicing sample and live processes stand up to regulatory and audit scrutiny.

Creating a compliant e invoicing sample is no longer optional for Malaysian businesses—it is a foundational requirement for tax accuracy, audit readiness, and operational continuity under LHDN’s MyInvois framework.

By following the eight structured steps outlined above, organisations can reduce rejection risks, strengthen documentation, and demonstrate regulatory discipline.

Whether you are an SME preparing for first-time implementation or a corporation managing complex structures, a well-prepared sample invoice sets the tone for long-term compliance and financial confidence.

If you want assurance that your e invoicing sample will stand up to tax review, audit scrutiny, or due diligence, professional guidance makes the difference.

Procheck Faculty Sdn Bhd brings over 25 years of hands-on experience in Malaysian taxation, accounting advisory, and regulatory compliance.

Our team supports businesses across industries with practical reviews, system alignment, and tax-ready documentation.

Speak to Procheck’s specialists today and strengthen your compliance strategy through our comprehensive Tax Services, tailored for SMEs, corporates, and growing organisations.

FAQ

What is an e invoicing sample, and why is it required in Malaysia?

An e invoicing sample is a test invoice file created in XML or JSON format to validate compliance with LHDN MyInvois rules, helping businesses confirm data accuracy before live submission and reducing audit and rejection risks.

When should a business prepare an e invoicing sample?

Businesses should prepare an e invoicing sample before system go-live, during software changes, or ahead of audits, restructurings, or mergers to ensure invoice data aligns with current regulatory and tax requirements.

Does every SME need to validate an e invoicing sample?

Yes, SMEs must validate an e invoicing sample to confirm mandatory fields, invoice types, and tax treatments are correct, even if they use basic accounting software or submit invoices through the MyInvois portal.

Can an e invoicing sample help during tax audits or M&A due diligence?

A properly validated e invoicing sample provides auditors and advisors with clear evidence of compliance, data integrity, and consistent invoicing practices, making it especially valuable during tax audits and mergers or acquisitions.

Should I engage a tax advisor to review my e invoicing sample?

Engaging a professional tax advisor adds assurance by identifying hidden compliance gaps, aligning invoices with tax regulations, and ensuring your e invoicing sample can withstand regulatory and audit scrutiny.